city of richmond property tax bill

We do not mail you a Property Tax Bill if your property taxes are paid through a bank or mortgage servicing company or if you have a zero balance. Property owners are responsible for making sure that they receive their tax bills and for making the required payments on time.

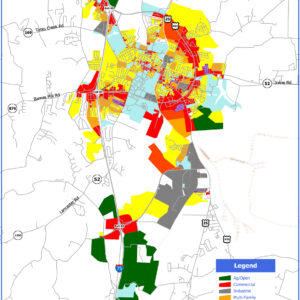

Geographic Information Systems And Mapping Codes Planning Safety Division

Tax Bill General Information.

. Disabled Veterans or their surviving spouses who believe they may be eligible for the real. Please note that failure to receive a tax bill does not negate the requirement to pay the tax. City of Richmond 2019 and newer property taxes real estate and personal property are billed and collected by the Ray County Collector.

Real Estate and Personal Property Taxes Online Payment. Demystifying Property Tax Apportionment httpstaxcolpcocontra-costacaustaxpaymentrev3summaryaccount_lookupjsp. To pay your 2019 or newer property taxes online visit the Ray County Collectors websiteAll City of Richmond delinquent taxes 2018 and prior must be paid to the City of Richmond Collector prior to paying 2019 or newer property taxes to the.

Call 804 646-7000 or send an email to the Department of Finance. All property owners in Richmond Hill must pay their property taxes. Search by Parcel ID Search by Property Address Search by Other Information.

Parking tickets can now be paid online. The interim bill is based on 50 of the previous years annualized taxes and is shown as a reduction on the final bill. The interim tax bills are mailed in January of each year with instalments due in March and May.

Collection of Taxes for Other Taxing Authorities Your annual property taxes collected by the City of Richmond funds municipal services and other taxing agencies such as the Province of BC School Tax TransLink BC Assessment Authority Metro Vancouver and the Municipal Finance. Residential and commercial property owners will receive a tax bill including their property tax rates property assessment and class and payment dates and deadlines. Late payment penalty of 10 is applied on December 6 th.

Property values are determined by the City Assessor and the Department of Finance issues the tax bills based on the valuation information provided by the Assessors Office. Team Papergov 1 year ago. Billing is on annual basis and payments are due on December 5 th of each year.

Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year. Yearly median tax in Richmond City. 209 of total minimum fee of 100.

Access Your Property Tax Bill. Failure to receive a tax bill does not relieve you of the penalty and the interest on a past due bill. If you are disputing the.

Your final tax bill is sent to you in June with instalments due in August and October. Only the registered property owner is allowed to change the mailing address. Richmond City has one of the highest median property taxes in the United States and is.

For commercial tenants wanting to change the mailing address of a utility bill contact the City of Richmond Tax Department at 604-276-4145 or TaxDeptrichmondca. See bill example to know How to Read Your Property Tax Bill. The City of Richmond Tax Collector is responsible for collecting property tax from property owners.

Bills are generally mailed and posted on our website about a month before your taxes are due. 1 Look Up State Property Records by Address 2 Get Owner Taxes Deeds Title. Real Estate taxes are assessed as of January 1 st of each year.

105 of home value. Ad View State Assessor Records Online to Find the Property Taxes on Any Address. The propertys Parcel ID should be entered such as W0210213002.

Online Property Tax Payment Fees. If you do not receive a bill it is your responsibility to investigate whether you have a liability to the Town. Richmond city collects on average 105 of a propertys assessed fair market value as property tax.

Business License - City of Richmond Instructions for Business License Online Payments httpsetrakitcirichmondcaus Parking Tickets - T2 Systems https. Richmond Hill issues two tax bills per year. Personal Property Registration Form An ANNUAL filing is required on all.

370 7 hours ago city of richmond personal property tax rate. Search by Parcel IDMap Reference Number. The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800.

Residential final tax bills. Partial Parcel ID may be entered but at least 8 digits should be entered in order to activate. Inquiresearch property tax information.

Parking Violations Online Payment. Personal Property Taxes are billed once a year with a December 5 th due date. They issue yearly tax bills to all property owners in City of Richmond and work with the sheriffs office to foreclose on properties with delinquent taxes.

City of Richmond Property Search. The interim bill is based on 50 of the previous years annualized taxes and is shown as a reduction on the final bill. Richmond City collects on average 105 of a propertys assessed fair market value as property tax.

Register to Receive Certified Tax Statements by email. This will change your mailing address for your Property Assessment Notice Property Tax Notice and your Utility Bills. Tax bills are mailed in the month of July.

Interest is assessed as of January 1 st at a rate of 10 per year. All late payments accrue interest. Create an Account - Increase your productivity customize your experience and engage in information you care about.

See bill example to know how to read your property tax bill. Pay property taxes online by credit card or e-check. Click Here to Pay Parking Ticket Online.

Pay Your Parking Violation. The City of Richmond is authorized by state law to levy taxes on real property in the city of Richmond.

Richmond Virginia Va Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Town Of Richmond Shawano County Wi Official Website

Municipal Court City Of Richmond

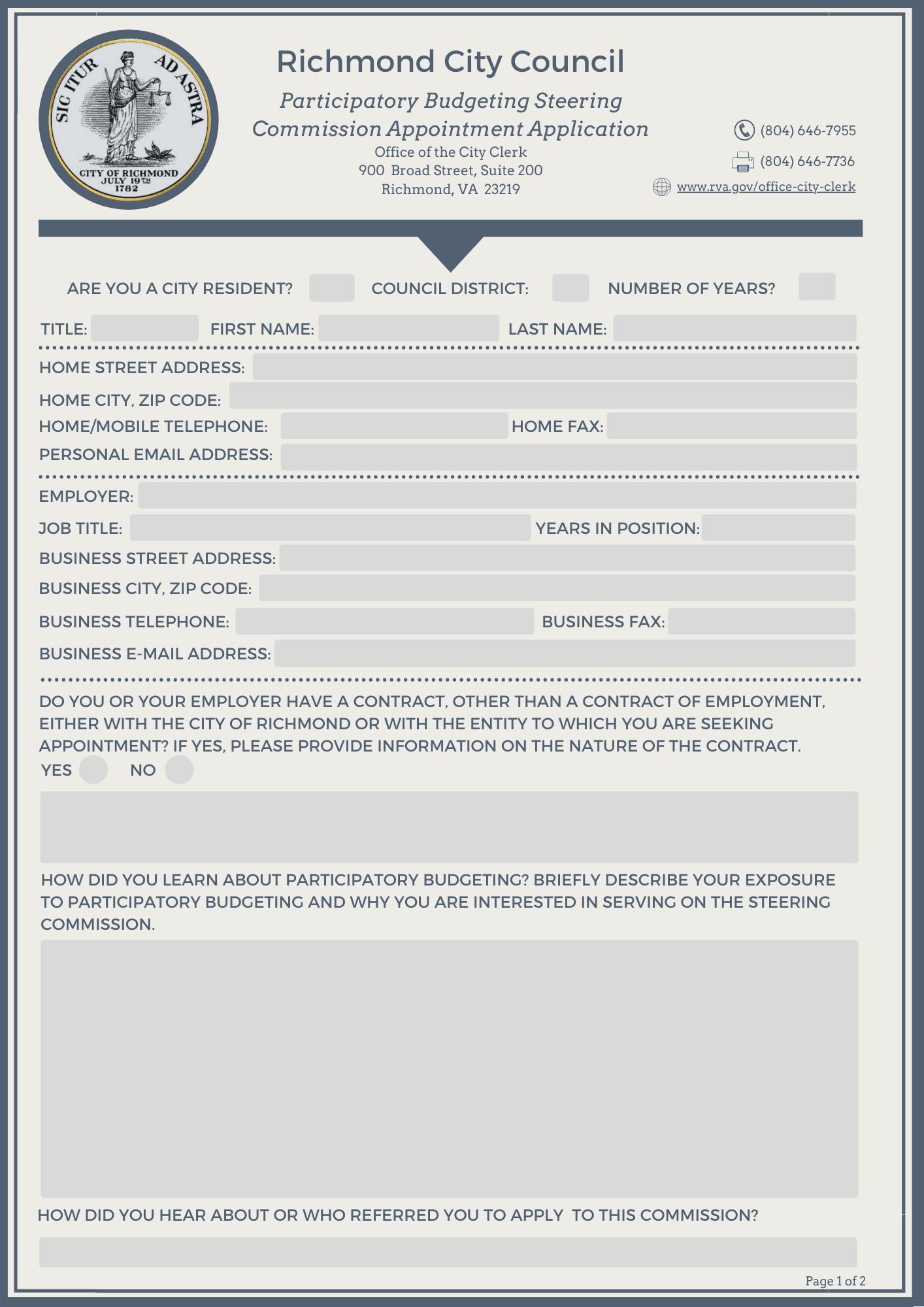

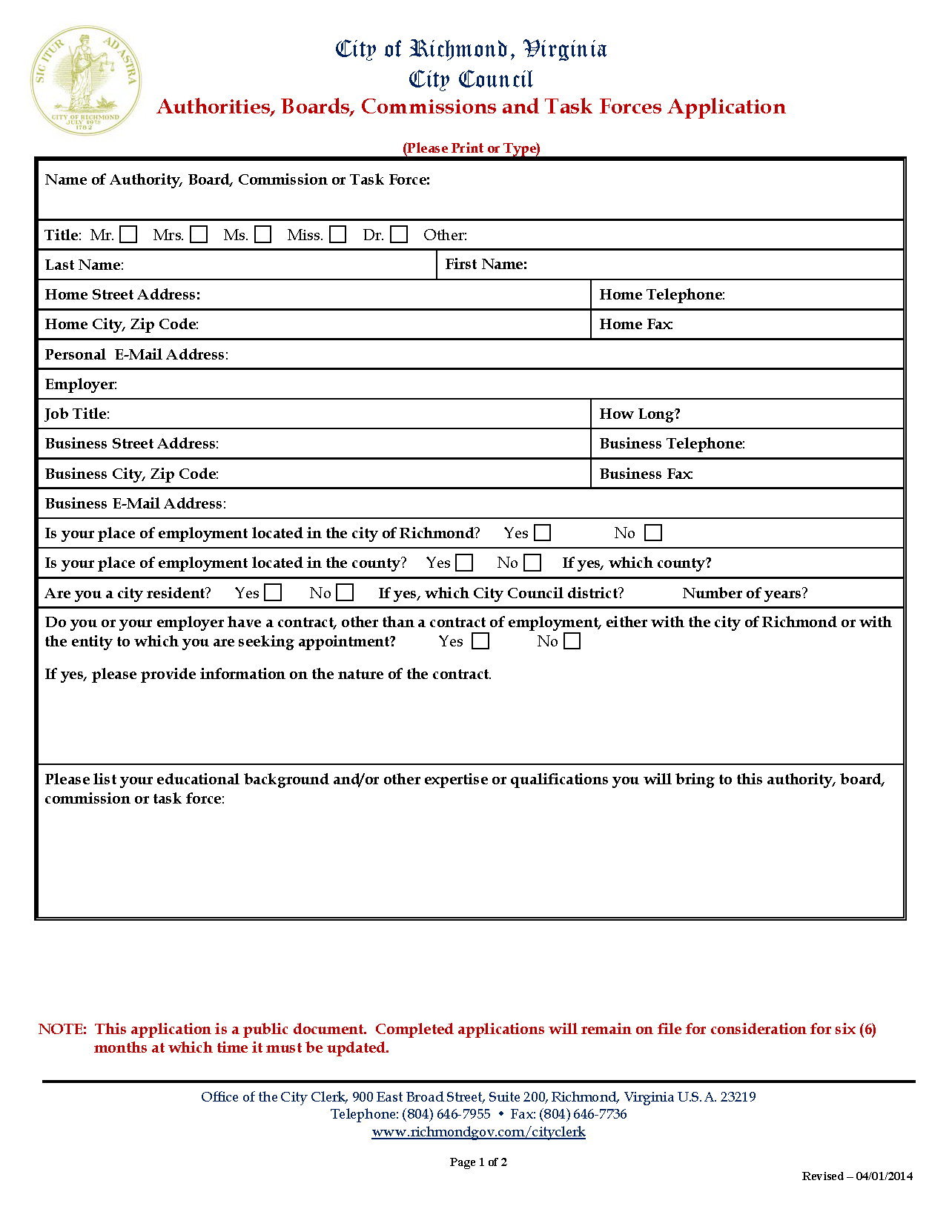

Boards And Commissions Richmond

2 3b Arena Anchored Development Planned For Best Products Site In Henrico Richmond Bizsense

Paul S Later The Village Cafe 939 W Grace St Ca 1925 Richmond Va Richmond Virginia History

1727 Lacassie Avenue Unit 5a Downtown Walnut Creek Ca Compass Walnut Creek Creek The Unit

Building Department City Of Richmond

Richmond Virginia Va Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Formerly Redlined Areas Of Richmond Are Going Green Chesapeake Bay Foundation

Boards And Commissions Richmond

Access Denied Ridgewood Property Records Street View

Property Tax Relief Available For Richmond Seniors Wric Abc 8news